we help service-based business owners, freelancers, and aspiring businesses with our content & services & When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Find out more about Income Wired

Are you tired of feeling uncertain about writing a check and not knowing how to fill out the “pay to the order of” line correctly? Fear not, as we have got you covered! This line is a critical component of the check-writing process, and if you’re unsure about how to fill it out, you may end up with a returned check or a delayed payment.

In this comprehensive guide, we’ll take you through everything you need to know about writing pay to the order of checks. From the basic rules to common scenarios for using them, exceptions and special cases, common mistakes to avoid, and tips for writing them effectively, you’ll have all the information you need to write a check confidently and accurately.

So, whether you’re writing a check to pay bills, transfer funds, or make a donation, this guide will provide you with the knowledge and confidence to fill out the “pay to the order of” line correctly and avoid any confusion or errors. Let’s dive in!

Basic Rules for Writing Pay to the Order of Checks

When writing a check, the “pay to the order of” line is where you specify the individual or organization that the payment is intended for. To ensure that the check is processed correctly, there are several basic rules that must be followed when filling out this line.

- First and foremost, it’s crucial to write the payee’s full name. This should be the same name that appears on their account or on their bill if you’re paying a bill. If you’re unsure of the exact name, you can reach out to the payee directly to confirm the details.

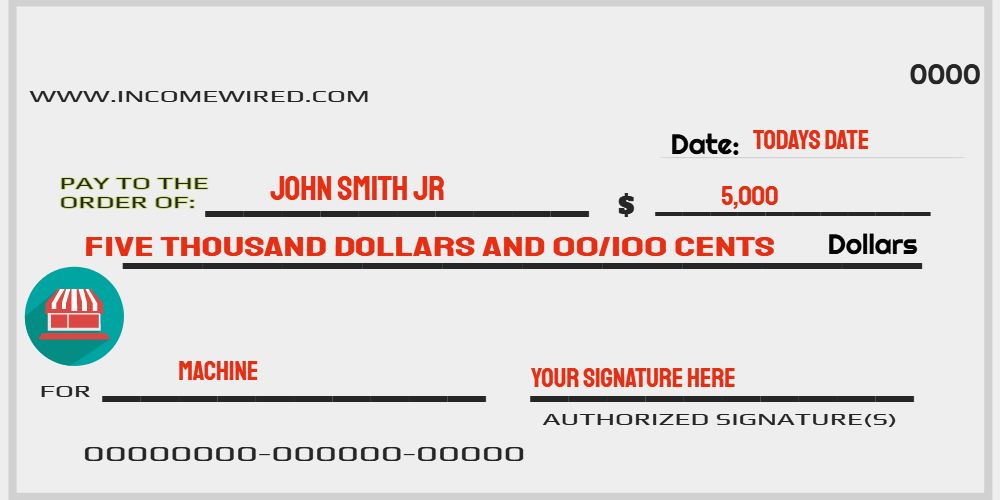

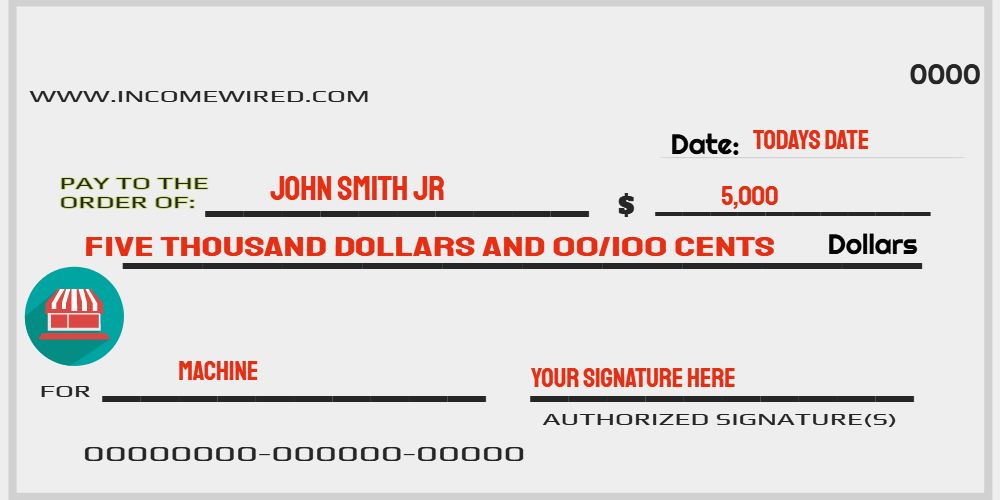

- If the payee has a title or an honorific, such as “Dr.” or “Jr.,” it’s important to include it in the name. This helps to ensure that the payment is directed to the correct individual or organization. For instance, if you’re paying a bill for John Smith Jr., you would write “John Smith Jr.” in the payee line.

- When filling out the “pay to the order of” line, it’s also essential to write clearly and legibly. This ensures that there’s no confusion about who the check is payable to, and the payment can be processed accurately. Illegible handwriting or misspelled names can lead to delayed or rejected payments.

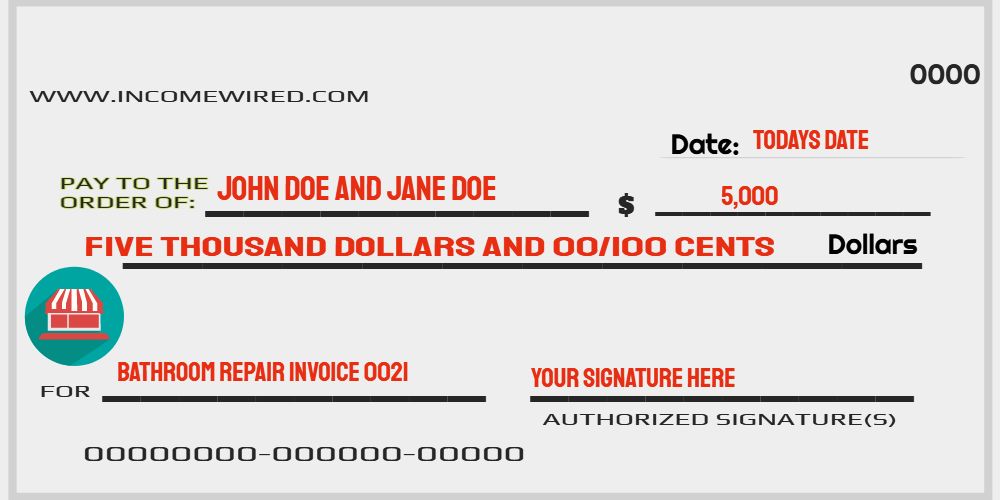

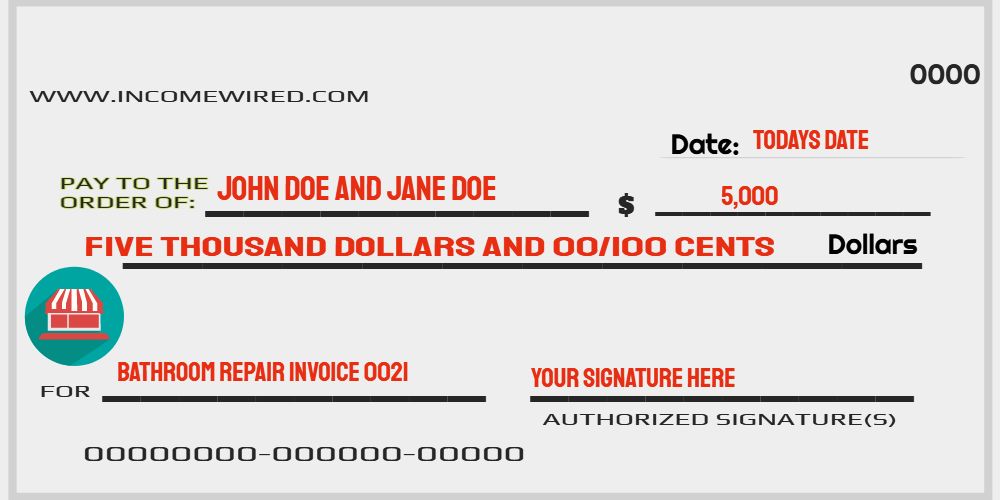

- Additionally, if you’re writing a check for a joint account, it’s important to list both names on the “pay to the order of” line. This ensures that both parties have access to the payment and can deposit or cash the check as needed.

By following these basic rules for writing pay to the order of checks, you can ensure that your payment is directed to the intended recipient and processed accurately. Taking the time to double-check the details can save you time and money in the long run and prevent any confusion or delays.

Common Scenarios for Pay to the Order of Checks

When it comes to pay to the order of checks, there are numerous scenarios in which they can be used. Below are some of the most common situations where pay to the order of checks are utilized:

- Paying Bills: One of the most common uses for pay to the order of checks is to pay bills. Whether it’s a utility bill, mortgage payment, or credit card bill, writing a check with the payee’s name and the amount due on the “pay to the order of” line can be a simple and convenient way to make payments.

- Making Donations: Pay to the order of checks can also be used to make charitable donations. Whether you’re donating to a non-profit organization, a religious institution, or a political campaign, you can make your contribution by writing a check with the organization’s name on the payee line.

- Transferring Funds: If you need to transfer funds to another person or organization, pay to the order of checks can be a useful tool. For example, if you’re buying a car from a private seller, you can use a pay to the order of check to transfer the funds for the purchase.

- Rent Payments: If you’re renting a property, pay to the order of checks can be used to make rental payments. This is especially useful if you don’t have access to online payment options, or if you prefer to have a paper trail of your transactions.

- Business Transactions: Pay to the order of checks can also be used for business transactions. For example, if you’re paying for services rendered by a freelancer or contractor, you can write a check with their name on the payee line and the amount due on the check.

- Reimbursements: If you need to reimburse someone for expenses, pay to the order of checks can be an easy way to do so. Simply write the payee’s name and the amount owed on the check, and they can deposit or cash it as needed.

By understanding the common scenarios where pay to the order of checks are utilized, you can be better prepared to use them in your own financial transactions. Always ensure that you follow the basic rules for writing pay to the order of checks to avoid any confusion or errors in the payment process.

Exceptions and Special Cases for Pay to the Order of Checks

Let’s dive deeper into the exceptions and special cases to consider when writing pay to the order of checks:

Writing multiple payees: If you need to pay more than one person or organization, you can write their names on separate lines or use the word “and” or “or” to separate them. For example, if you’re paying a bill jointly with your spouse, you could write “John Doe and Jane Doe” on the payee line.

- If you’re paying multiple vendors for a business expense, you could write “ABC Company and XYZ Company” on the payee line. Alternatively, you could write “Pay to the order of ABC Company or XYZ Company” if you’re only paying one of the vendors.

- Writing business or organization names: If the payee is a business or organization, you’ll need to write the full name of the business or organization in the payee line. This is important to ensure that the payment is properly credited to the intended account.

- If the business or organization has a specific account number or department, you can include that information after the name. For example, if you’re paying a bill to a hospital, you could write “Hospital Name, Account #123456” on the payee line.

- Another exception to consider is if the payee is a government agency. In this case, you may need to include additional information such as the specific department or agency name, and the purpose of the payment. For example, if you’re paying a tax bill to the IRS, you could write “Internal Revenue Service, Payment for Tax Year 2025” on the payee line.

It’s important to be clear and accurate when writing pay to the order of checks for multiple payees or business/organization names to avoid any confusion or errors in the payment process.

Common Mistakes to Avoid with Pay to the Order of Checks

Writing a pay to the order of check accurately is crucial to ensure that the funds are directed to the right payee. To avoid errors and potential financial issues, it’s important to be aware of common mistakes to avoid. Some of the most common mistakes to avoid when writing pay to the order of checks are:

- Misspelling payee names or using incorrect titles or honorifics: It’s crucial to spell the payee’s name correctly, as it appears on their account or bill. Moreover, if the payee has a title or honorific, such as “Dr.” or “Jr.,” it should be included in the name. Failure to do so can cause issues when the payee tries to cash or deposit the check.

- Writing the wrong amount: This is a common mistake that can happen when transposing digits or forgetting to include cents. It’s important to double-check the written amount and ensure that it matches the numerical amount on the check.

- Using the wrong account to withdraw funds: It’s important to ensure that the payee has authorized the check and that it’s linked to the correct account to withdraw funds. Using the wrong account can result in insufficient funds, overdraft fees, or even legal issues.

- Writing checks without sufficient funds: Writing checks without sufficient funds in your account is a serious offense and can result in legal and financial consequences. It’s important to keep track of your account balance and ensure that you have enough funds to cover the check.

- Forgetting to sign the check: A signed check is required for it to be valid. Forgetting to sign the check can result in the payee being unable to cash or deposit the check.

By being aware of these common mistakes and taking the necessary precautions, you can ensure that your pay to the order of checks are written accurately and effectively.

Tips for Writing Pay to the Order of Checks

Writing pay to the order of checks correctly is crucial to avoid errors, confusion, or even fraud. Here are some tips to help you write these checks effectively:

- Double-check the payee name and amount: Before writing the check, ensure that you have the correct name and the accurate amount. This can help avoid errors, such as misspelling the payee’s name, writing the wrong amount, or making other mistakes.

- Write legibly and clearly: Write the check neatly and legibly to avoid any misinterpretation of the details. Use a pen with black or blue ink to ensure that the check can be read clearly.

- Keep accurate records: Record all pay to the order of checks you write in a ledger or other record-keeping system. This can help you keep track of your spending and ensure that you have enough funds in your account to cover the checks.

- Use memo lines: Use the memo line on the check to provide additional details about the payment, such as what the payment is for or a reference number. This can be helpful for record-keeping purposes.

- Keep your checks secure: Keep your checks in a secure location and only write checks to trusted individuals or organizations. Consider using a checkbook register to keep track of your checks and prevent fraud.

In conclusion, by following these tips, you can write pay to the order of checks effectively and avoid errors or fraud. It’s important to take the time to double-check the details and keep accurate records to ensure a smooth and secure financial transaction.