we help service-based business owners, freelancers, and aspiring businesses with our content & services & When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Find out more about Income Wired

It is unnecessary for the answer to the question “How much earnings is required for me to retire at the age of 55?” to be overly complicated.

Even while everyone has a specific perspective of how they wish their retirement to pan out, it can be helpful to look at some current benchmarks to determine whether or not you are heading in the right direction.

The following set of inquiries and tactics for retirement planning will assist you in calculating the amount of money necessary for your retirement.

It’s not about the cash; it’s about the earnings

When figuring out your “number” for retirement, remember that it is not about settling on a specific amount of money to save. For instance, the typical target for retirement savings in the United States is one million dollars in a savings account. However, this line of reasoning needs to be revised.

When calculating how much money you’ll need to retire, the most significant consideration is whether or not you’ll have the funds to generate the income you’ll need to maintain the standard of living you want once you’ve left the workforce.

Will having a savings balance of $1 million enable you to generate sufficient income for the rest of your life? Maybe, but perhaps not. In this post, we will find out the answer to that question.

What should you do first?

Are you considering taking early retirement? If this is the case, you must check the balances of your retirement accounts as soon as possible. And plan how you will continue your current standard of living.

Planning is necessary for retirement at any age; there are common retirement savings objectives that should be strived for throughout one’s career.

If you are considering retiring at the age of 55, you will want to be sure that you have sufficient savings to live off of comfortably.

It would be best if you estimated your particular requirements and objectives. This includes determining the amount you intend to spend annually after you retire. When you plan to stop working is another factor to consider.

A person who works for a longer period and retires in their mid-60s will have a greater demand for financial resources than someone who retires in their mid-40s.

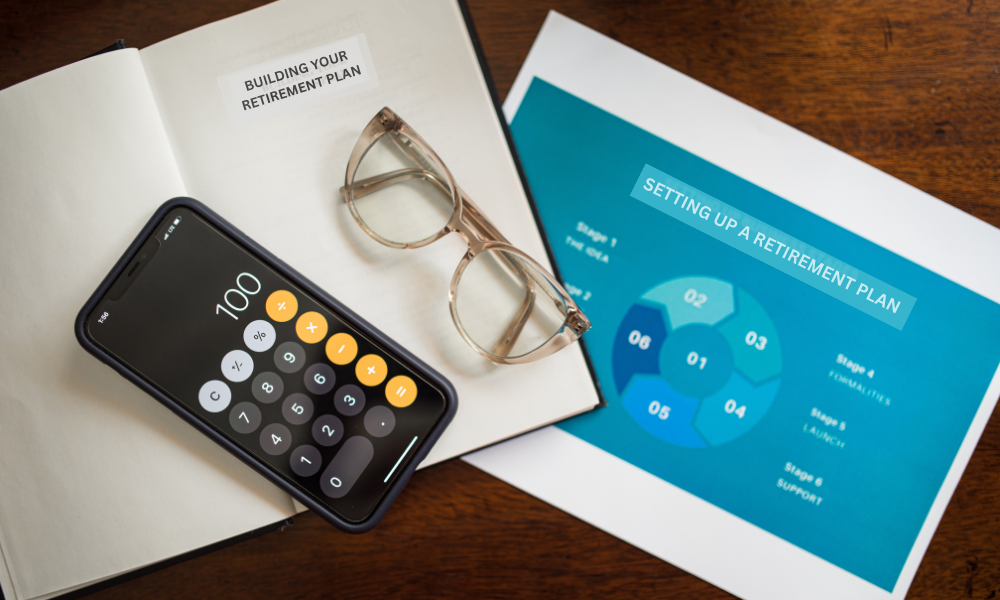

How to make a Retirement Plan?

At any age, most financial consultants advise saving at least 15% of your yearly gross income for retirement. These investments are funds you may be saving for immediate objectives like a new automobile and unanticipated costs and disasters like medical bills.

It is only sometimes necessary to begin retirement savings. You can take practical, realistic actions to reach the advised retirement savings goal at any age.

Financial professionals suggest several retirement savings options. Examining the recommendations carefully is a good idea because each has benefits and drawbacks. Let’s look at three typical rules of thumb.

Multiples Your Annual Income

Depending on your age and earnings, economists advise saving a particular proportion of your income. It suggests this approach since the amount you must save for retirement is greatly influenced by your age.

When you’re younger, your percentage starts lower, but by the time you’re ready to retire, compound interest will still have helped you attain your comfortable retirement goal.

When you’re 25 years old, the brokerage advises that you begin by investing extensively in riskier, more aggressive assets, such as equities, and saving a minimum of 15% of your gross income.

The 4% Approach

The 4% guideline suggests withdrawing 4% of retirement funds in the last 30 years. This guideline requires a 4% first-year withdrawal. Your withdrawal rate would be adjusted for inflation in subsequent years.

Say your retirement budget is $40,000. The 4% guideline requires $1,000,000 for retiring or 25 times your yearly expenses. You would withdraw $40,000 the first year after reaching that target.

In year two, you’d withdraw $41,600 ($40,000 X 0.04) + $40,000 = $41,600) if inflation was 4%.

Though simple, the 4% rule has drawbacks. If you need more saved, removing 4% annually could deplete your funds faster. The rule also ignores market changes.

Salary Percentage Technique

Experts advise saving 70–80% of preretirement income. If you made $100,000 before retirement, you should spend $70,000–$80,000 in retirement.

This technique is simple to calculate. The result can estimate retirement savings. If you earn $50,000 and expect to retire for 30 years, you’ll need $1.5 million ($50,000 x 30).

This guideline ignores inflation, which is a drawback. You need to adjust your pay for inflation to know how much you’ll need to retire. An online calculator (search for “ahead flat rate“) or the rule of 72 may be easiest.

It takes 72 years to double your living expenses divided by the average inflation rate. 3% inflation takes 24 years to double it. An inflation calculator is more accurate.

It’s only possible to estimate how much money you’ll need because you can estimate how long your retirement will continue. However, it can help you start saving a portion of your salary for retirement and savings.

Consider pensions, Social Security, and other secure income sources

If you’re like the average person, you’ll also receive assistance from places other than personal savings, such as Social Security. Social Security checks are a major part of most people’s annual budgets.

Those with higher incomes in retirement will have a smaller share of their income replaced by Social Security. So, if you make $50,000 a year, for instance, 35% of your income can be replaced by Social Security, according to Fidelity.

But the average replacement rate for a person who earns $300,000 per year is only 11%, thanks to Social Security.

Check your most recent Social Security statement or sign up for a personal Social Security account to see an estimate based on your earnings record if you are unsure.

What Kind of Retirement Income Can You Anticipate Needing?

Plan on living off at least 65–75% of your current salary when you retire, but ideally, you should plan on living off 80% of your actual salary. This is the recommendation of several financial advisors and other professionals.

Considering these factors, you may need up to 12 times your present yearly wage saved up on retirement time. At the age of 55, financial advisors recommend having saved at least 7 times your annual pay.

If you have an annual income of $55,000, you must have a minimum savings of $385,000 for your retirement.

Always remember that life is full of surprises, including economic considerations, medical care, and the length of your life will all affect the costs associated with your retirement.

Therefore, it is recommended that you save more than the typical amount for retirement to offer yourself a buffer.

Take an Example

Consider the following illustration to better see the necessity of a specialized retirement plan. Imagine that two individuals, John and Martin, wish to retire in twenty years and have a retirement fund of one hundred thousand dollars when they are 35 years old.

When John retires, one of his goals is to do more traveling. His anticipated annual retirement budget is $100,000.

In the meanwhile, Martin anticipates retiring to a place with a cost of living that is lower than his current location and spending an annual total of $40,000. John will need to put up more money for retirement than Martin because the former anticipates spending more during his golden years.

Like John and Martin, you will need to determine your goals before you can determine how much money you will need to save.

Ask Yourself

Asking yourself the following 4 important questions will allow you to reach a more accurate estimate of the amount of money you need to save for retirement:

How much of your total debt do you anticipate paying off before you retire?

The total amount of debt you carry into retirement, as well as your strategy for paying it off, will both have an impact on the amount of money you will require.

Where do you want to retire, and what is the living expense there?

Do you have plans to relocate once you start enjoying your retirement? Is there a trend toward a higher cost of living in the area that you currently call home?

How would you describe the kind of lifestyle that you want to lead?

Is it a goal, for instance, to go on vacation? You can set a savings target more easily if you have a good estimate of how much you’ll require in savings to maintain the standard of living you want in retirement.

At what time do you anticipate taking retirement?

The typical retirement age in the United States is between 62 and 65 years old, but some people may choose to retire either sooner or later than this. But reaching a certain age isn’t the only thing that matters when figuring out whether to stop working.

Conclusion

In light of the information above, you may require savings equal to 10 to 15 times your present yearly pay by the moment you reach retirement age. At the age of 55, financial advisors recommend having saved at least 7 times your annual pay.

If you have an annual income of $55,000, you must have a minimum savings of $385,000 for your retirement.