we help service-based business owners, freelancers, and aspiring businesses with our content & services & When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Find out more about Income Wired

Starting a business in Florida is a great way to get your feet wet in the entrepreneurial world. The state is home to many small businesses and startups, so there is a lot of opportunity for growth. However, starting a business can be a daunting task, especially if you’re not sure where to start.

This guide will show you how to start a business in Florida, from incorporating your business to getting the necessary licenses and permits. We’ll also touch on the cost of starting a business in Florida and some resources that can help you get started.

Why You Should Initiate Your Own Business:

If you want to be your own boss, have more control over your career, and make a difference in your community, starting your own business is a great option. Not to mention, Floridians are no strangers to entrepreneurship. In fact, Florida is ranked as the third most entrepreneurial state in the country.

Market Analysis: Florida by Numbers

Population: 21.5 million 3rd largest in the U.S

Small Businesses: 2.8 million as of 2022

Minimum Wage: to see the latest click here( You’ll be directed to the minimum wage site)

Economic Growth: Upward Trend

sources: https://www.dol.gov/agencies/whd/minimum-wage/state#fl

Benefits of Starting Your Business in Florida

- The state has a large population and customer base.

- There is no personal income tax in Florida.

- A favorable tax climate for businesses

- No state income tax

- A large market of potential customers

- A growing economy

- Access to funding and resources

- A supportive ecosystem for startups and small businesses

Overall there are many reasons why starting your business in Florida is a great idea. The state has a large population which means more potential customers for your business. Additionally, there are no state income taxes so you can keep more of your profits. The tax climate is also favorable for businesses and the economy is growing which provides access to funding and resources. Lastly, the startup ecosystem is supportive of small businesses. All of these reasons make Florida an ideal state to start your business.

So now that we’ve gone over some of the reasons why you should start your business in Florida, let’s get into how you can actually do it.

How to Start a Business in Florida: The Step by Step Guide

- Brainstorm Your Business Ideas

- Create a Business Plan

- Explore Funding for your new business in Florida

- Structure Your Florida Business:

- Register Your Florida Business For Taxes

- Acquire Necessary Permit & License for Your Business

- Get Insurance For Your Business

- Setting Up Your Business Bank Account

- Estimates, Work Orders, Invoices & Accounting For Your New Florida Business

- Create an Online Business Presence

- Getting Leads & Calls for Your Florida Business

- Engage with local networks, Family & Friends-Spread the Word

- Hiring Help For Your Business

- Plan Ahead For Your Business

Becoming Your own boss is a great way to have control over your career, make a difference in your community, and achieve financial independence. If you’re ready to take the plunge and start your own business, Florida is a great state to do it. With a large population and favorable tax climate, there are many opportunities for businesses to thrive in Florida.

#1)Brainstorm Your Business Ideas

Coming up with a good business idea is the first step to starting your own business. If you’re not sure what kind of business you want to start, consider your hobbies, skills, and interests. You can also look at businesses that are doing well in Florida and see if there’s an opportunity for you to fill a niche market.

Think about what your experience is and what you are good at. What are some problems that you see in your industry that you could solve? Are there any products or services that you wish were available but aren’t? These are all great starting points for brainstorming business ideas.

Service Vs Non- Service Business Ideas

If you’re not sure what kind of business you want to start, it can be helpful to think about whether you want to start a service-based business or a product-based business.

Service-based businesses provide a service to their customers, such as landscaping, cleaning, or personal training. These businesses typically require less capital to start because you won’t need to invest in inventory or manufacturing equipment.

Product-based businesses involve selling products that you make or resell. These businesses typically require more capital to start because you’ll need to invest in inventory and manufacturing equipment.

Once you have an idea of the type of business you want to start, it’s time to create a business plan.

#2)Creating a Business Plan

Your business plan is a roadmap for your business. It will outline your goals, strategies, and how you plan on achieving them. This document is important not only for helping you get organized and focused, but it will also be necessary if you ever need to apply for loans or investment funding.

- Executive summary of the overall business

- General description of the company

- Introduction

- Organizational structure

- Market research and competitor analysis

- Description of your products and/or services

- How you plan to market and sell your products

- Financial projections and funding plans

- Sales & Marketing Strategies

- Roadmap for your business

- Projected growth based on your business plan

- Appendix

Each of these sections is important and should be given careful thought and attention.

Choosing the Location For Your Florida Business:

The next step is to choose a location for your business. This can be tricky, especially if you’re starting a brick-and-mortar business. You’ll need to consider the cost of rent, whether there’s foot traffic in the area, and if the location is convenient for your customers. Some businesses do well in rural areas, while others need to be in a more populated area to succeed. It all depends on your specific business and what your customers are looking for.

Once you’ve found the perfect location, it’s time to start thinking about the cost of starting your business. Alternatively, you can start with a website and then expand to a physical location when your business is doing well.

Cost of Starting Your Business In Florida:

The cost of starting your business in Florida will vary depending on the type of business you’re starting and your specific circumstances. For example, if you’re starting a brick-and-mortar store, you’ll need to factor in the cost of rent, utilities, and inventory. If you’re starting a service-based business, you’ll need to factor in the cost of marketing and advertising.

Here are some startup costs you need to keep in mind:

- Business licenses and permits

- Equipment

- Insurance

- Rent or mortgage payments for office space

- Office supplies and furniture

- Marketing and advertising

- Inventory

- Web design and hosting

- Accounting software

- Payroll if you’re going to get employees

Think About Your Target Audience & Target Market:

Before you can start marketing your business, you need to know who your target audience is. This will help you determine where to advertise, what type of advertising to use, and what type of messaging will resonate with your audience.

Your target audience is the group of people most likely to buy your products or services. To determine your target audience, you need to think about who your ideal customer is. Consider their age, gender, location, income, and interests.

Once you’ve determined your target audience, you need to think about your target market. This is the group of people who you want to reach with your marketing. Your target market will be based on your target audience, but it’s important to consider other factors such as your budget and the type of products or services you’re selling.

Selecting a Name for Your Florida Business

After you’ve chosen a location and determined your startup costs, it’s time to start thinking about what you want to name your business. This can be a difficult task, but it’s important to choose a name that is catchy and easy to remember. You also want to make sure the name you choose is available as a domain name and that you can get the appropriate business licenses and permits.

There are a few things to keep in mind when choosing a name for your business:

- choose a name that is easy to remember

- find a name that is related to your products or services

- To find out locally required permits, or certifications look up your local Florida local government here

- To search for state-required licenses in Florida click here

- Is your Name Already Taken? To search existing business names already taken, click here:

Another thing you can do is check if your website domain name is available

Remember: Its recommended to get a domain name that matches your business name

- Do NOT get a name that is an existing registered trade name, you must NOT choose a name that is deceptively similar to another business

- To search the State of Florida database for existing trademarks, click here

- to search for existing trademarks in the USA click here

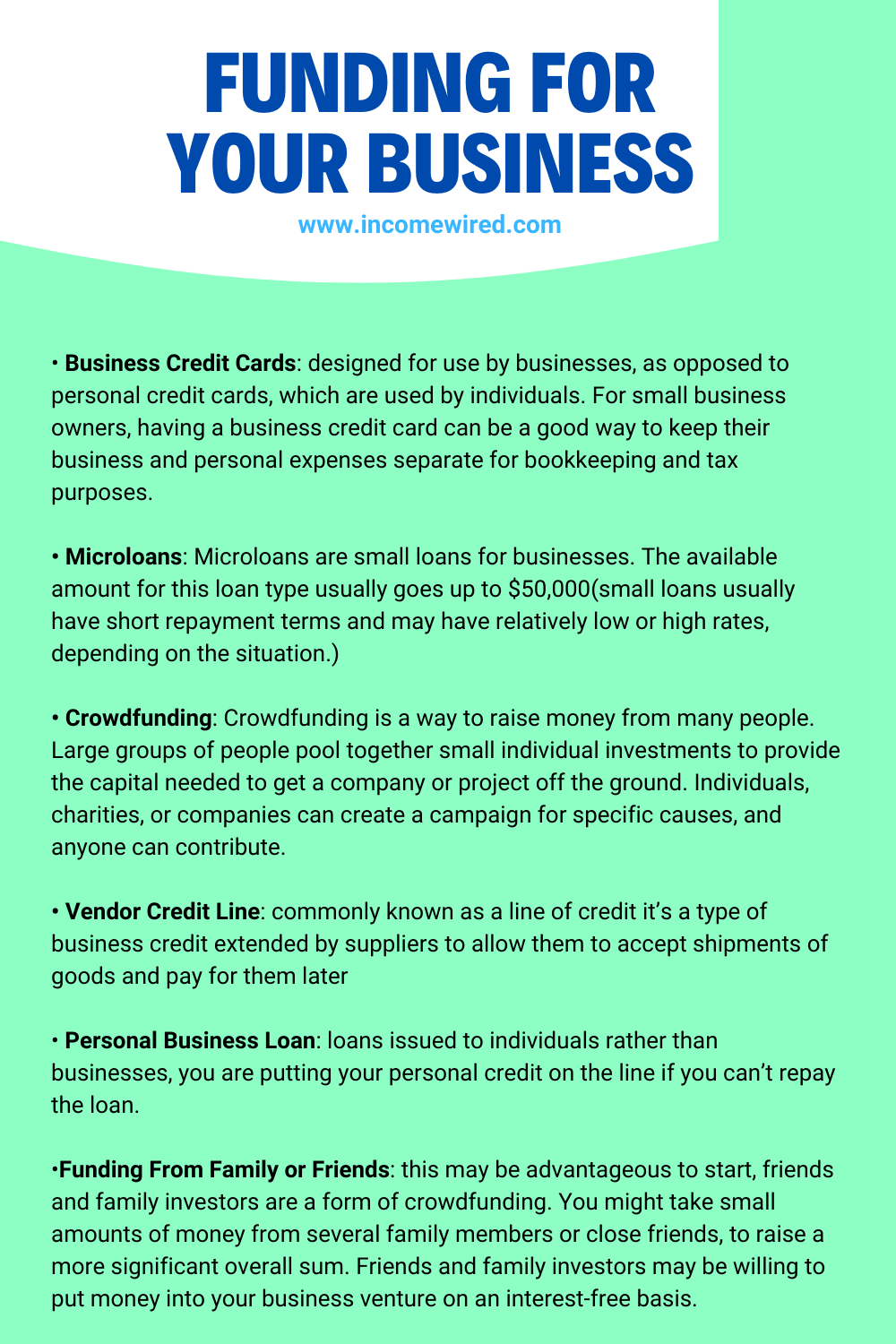

#3)Explore Funding for your new business in Florida

One of the most important things to consider when starting a business is how you’re going to fund it. There are a few different options available, and it’s important to explore all of them before making a decision.

Here are some funding options for businesses in Florida:

Small Business Administration (SBA) Loans: The SBA offers a variety of loan programs for small businesses, including startup companies. You can find more information on their website or by contacting your local SBA office.

https://www.sba.gov/funding-programs/loans

or you can look at these alternatives:

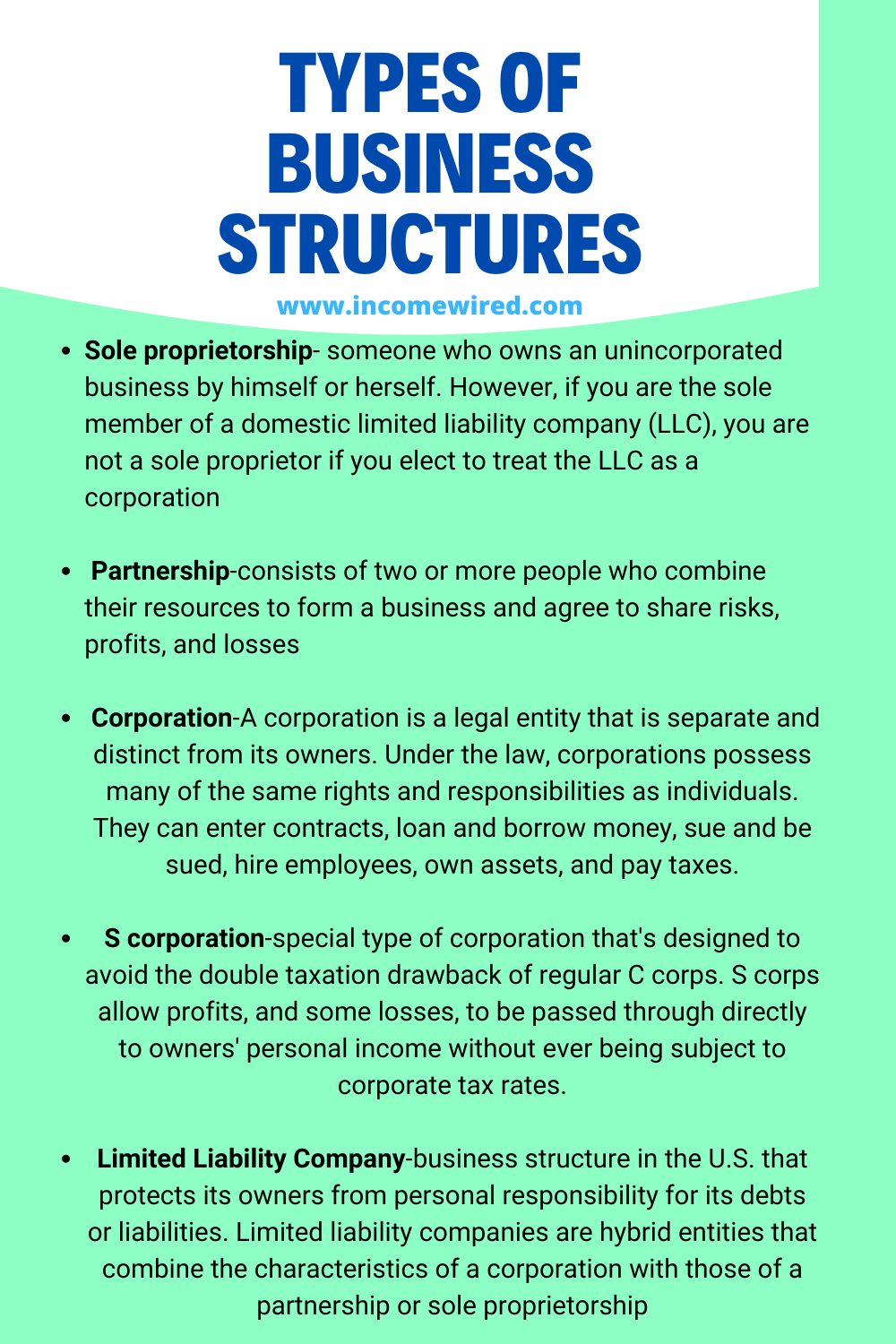

#4)Structure Your Florida Business:

Here are the most common type of business structures you must know about:

To form LLC you have two options either do it yourself or hire a professional which is recommended.

#5)Register Your Florida Business For Taxes:

The type of tax registration you need will vary depending on the type of business you’re starting.

Apply For EIN:

Here are common Taxes You Need to Know About:

- Federal Business Tax: All businesses must pay federal income tax. You can find more information on the IRS website or by contacting your local IRS office.

State Business Tax: Depending on the state in which you’re starting your business, you may be required to pay state income tax. You can find more information on your state’s website or by contacting your local tax office.

https://floridarevenue.com/Pages/default.aspx - Local Business Tax: Depending on the city or county in which your business is located, you may be required to pay local business taxes. You can find more information on your local government’s website or by contacting your local tax office.

https://www.floridaleagueofcities.com/research-resources/municipal-directory - If you have employees, you’ll need to withhold state and federal taxes from their paychecks and file quarterly tax reports.

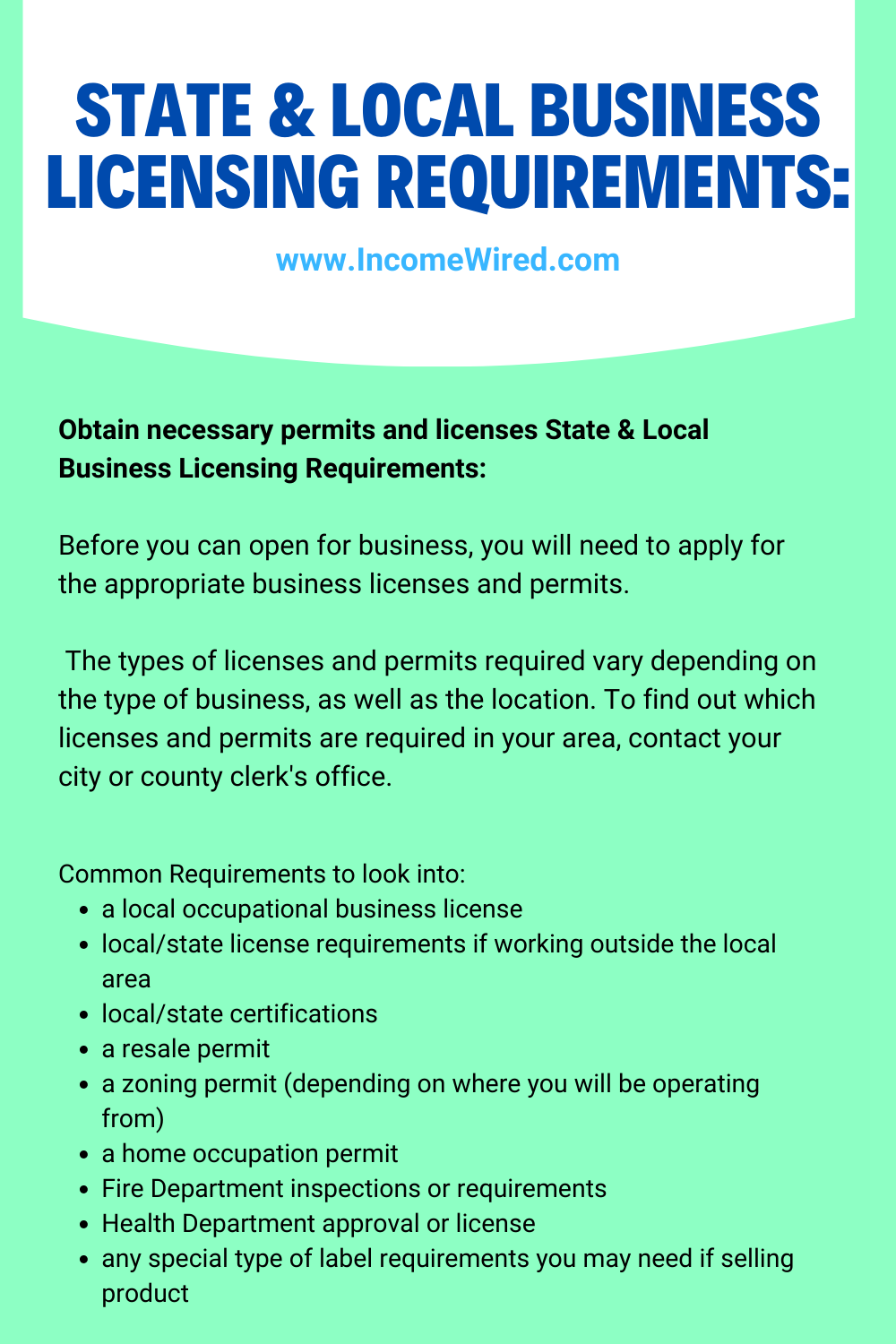

#6)Acquire Necessary Permit & License for Your Business

After you’ve chosen a business structure and registered your business for taxes, you’ll need to acquire any necessary permits and licenses. The type of permit or license you need will vary depending on the products or services you’re offering and the location of your business.

- Contact the local County Tax Collector for any local license requirements here

Regulated Industries: If your business is in a regulated industry, you’ll need to acquire the appropriate state license. You can find more information on the Florida Department of Business and Professional Regulation website here

- Reminder: You’ll need to file an Annual Report with the state of Florida, which is due by May 15th each year.

#7)Get Insurance For Your Business

All businesses need to have insurance. The type of insurance you need will vary depending on the products or services you’re offering and the business structure you’ve chosen.

There are many types of business insurance policies available, so it is important to speak with an insurance agent to determine which type of coverage is right for your business.

some common types of business insurance include:

- general liability insurance

- product liability insurance

- property damage insurance

- business interruption insurance

- worker’s compensation insurance

Get a Free Quote Here

#8)Setting Up Your Business Bank Account

Opening a business bank account is a relatively simple process. You’ll need to provide the following documents:

- Business License

- Employer Identification Number (EIN)

- Articles of Incorporation (if you’re a corporation)

- Partnership Agreement (if you’re a partnership)

It an also beneficial to get a business credit card as there are benefits of getting a credit card for your business:

- A business credit card can help you build business credit, which can be helpful if you need to take out a loan for your business in the future.

- A business credit card can help you manage your business expenses and keep track of employee spending.

- A business credit card can offer rewards and perks, such as cash back or travel benefits.

#9)Estimates, Work Orders, Invoices & Accounting For Your New Florida Business

One of the first things you’ll need to do is set up a system for estimates, work orders, and invoices.

Markate– a software that helps you manage everyday business activities, e.g., estimates,work orders, invoices & even scheduling

Once you have a system set up, you’ll need to start keeping track of your income and expenses. This is important for two reasons:

- You’ll need this information when it comes time to file your taxes.

- You’ll need this information to apply for loans or other forms of funding.

There are a few different ways to keep track of your income and expenses:

- You can use accounting software like QuickBooks

- You can hire an accountant to do it for you.

- You can do it yourself using a spreadsheet.

The best way to keep track of your income and expenses will vary depending on the size and complexity of your business. If you’re just starting out, you may want to do it yourself using a spreadsheet. Once your business starts to grow, you may want to hire an accountant or switch to accounting software.

#10)Create an Online Business Presence

These days, it’s important to have an online presence for your business. This can be in the form of a website, a blog, or social media accounts.

If you don’t have any experience with web design or social media, there are a few options available:

You can hire someone to create a website or social media account for you.

You can use a platform like WordPress or Squarespace to create a website yourself.

You can use a platform like Hootsuite or Buffer to manage your social media accounts.

Creating an online presence for your business is important because it helps you reach more customers and connect with them on a deeper level. It also allows you to build trust and credibility with potential customers.

#11)Getting Leads & Calls for Your Florida Business

Now that you have a website and social media accounts set up, it’s time to start getting leads and calls for your business.

There are a few different ways to generate leads:

- use search engine optimization (SEO) to make sure your website appears in search results when people are looking for products or services like yours.

- use pay-per-click (PPC) advertising to place ads on search engines and other websites.

- use social media marketing to promote your business on social media platforms like Facebook, Twitter, and Instagram.

- use email marketing to send newsletters, coupons, and other promotional materials – use content marketing to create blog posts, videos, and other types of content that potential customers will find useful.

- Create business cards, flyers, and other marketing materials to promote your business in person.

- put your phone number on the company vehicles

- Attend trade shows and other events in your industry.

Converting Leads into Customers

Once you start getting leads, it’s time to start converting them into customers.

There are a few different ways to convert leads into customers:

- use a sales script to make sure you’re covering all the important points when you’re on the phone with a lead.

- use a CRM system to track your leads and customers and keep track of your interactions with them.

- offer discounts or free trials to encourage people to buy from you.

- use social proof, like testimonials and customer reviews, to build trust with potential customers.

The best way to convert leads into customers will vary depending on your industry, target market, and sales process. You may want to experiment with a few different methods to see what works best for you.

Now that you know how to start a business in Florida, it’s time to get out there and start building your empire!

#12)Engage with local networks, Family & Friends-Spread the Word

One of the most important things you can do when starting a business is to engage with local networks, family, and friends.

Spreading the word about your business is essential for getting it off the ground, and these are people who are likely to be your biggest supporters.

Make sure you have a solid elevator pitch prepared so you can tell people what your business is all about, and be sure to have some business cards on hand so you can give them out.

Attend local networking events, meetups, and Chamber of Commerce functions. Get involved with local organizations and charities. And don’t forget to let your family and friends know what you’re up to!

Hiring Help For Your Business

Once your business starts to grow, you may need to hire some help.

You may want to hire an accountant or bookkeeper to help with your finances.

You may want to hire a Virtual Assistant (VA) to help with tasks like customer service, social media, and email marketing.

Or you may want to hire a web developer or graphic designer to help with your website and marketing materials.

Hiring help can be a big step for a small business, but it’s often necessary in order to continue growing.

Plan Ahead For Your Business

One of the most important things you need to do is plan ahead. Learn the market and trends in your industry.

Create a business plan. Set goals and objectives for your business, and create a roadmap for how you’re going to achieve them.

Make sure you have the financial resources in place to sustain your business. And put systems and processes in place so your business can run smoothly.

Running a small business is a lot of work, but it can be very rewarding. By following these tips, you’ll be on your way to success.