we help service-based business owners, freelancers, and aspiring businesses with our content & services & When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Find out more about Income Wired

In today’s economy, it is more important than ever to save money. In this guide, we will teach you how to save $5000 in 3 or 6 months. We will provide tips and tricks on how to cut your expenses and live a frugal lifestyle. So whether you are looking to save for a rainy day or want to get ahead on your retirement savings, follow these steps and you will be well on your way!

How to save $5000 in 2 months

Although this may not be for everyone due to different income levels. You can learn from the overall concept to apply it to any other time frame.

- Start by evaluating your current spending habits and find areas where you can cut back.

- Create a budget and stick to it.

- Save money on groceries by meal planning and cooking at home.

- Eliminate unnecessary expenses, such as cable TV or subscriptions that you don’t use.

- Consider getting a second job or finding ways to make extra money.

Do the math: If you have an average of 9 weeks in two months, you have to divide

$5000 divided into 9 weeks it’s an approximate:$556 per week

How can I save $5000 in 3 months?

Saving $3000 dollars in just three months may seem like a daunting task, but it is definitely achievable with some lifestyle changes and commitment. If you are looking to save $5000 in three months, here are some tips:

-Create a budget and stick to it: This is probably the most important tip when it comes to saving money. You need to be aware of your spending patterns in order to make changes. Track all of your expenses for one month so that you can get an idea of where your money goes each month. Once you have a good understanding of your spending patterns, you can start making adjustments.

-Cut back on unnecessary expenses: After creating a budget, you will probably have a better idea of what expenses are necessary and which ones are not.

The coffee example:

If you spend about $2 on average per day each morning on coffee, and you work 7 days a week(it happens), then that is $14 per week. There is an average of 13 weeks in 3 months, so that’s $14 x 13 weeks. That’s $182 approximately that you can save. That’s just the coffee example.

How can I save $5000 in 3 months Tips:

- Start cooking at home: Eating out can be expensive, especially if you are doing it multiple times a week. By cooking at home, you can save a lot of money. Not to mention, it is usually healthier!

- Find ways to make extra money: There are many ways to make extra money these days. You could start freelancing, take on a part-time job, or even start a side hustle. Any extra income can help speed up the process of reaching your savings goal.

- You can mow some lawns

- You can babysit

How to save $5000 in 3 months envelope technique

Another great way to save money is to use the envelope technique. This is where you designate a certain amount of cash for each expense.

Ideally, you would want to make an overall assessment of how much money you actually spend each month. This could be done by either looking through bank statements or tracking your spending for a month.

Once you have determined how much you spend each month, you can start allocating cash to specific expenses. For example, if you spend $500 on groceries per month, you would put $500 in cash in an envelope labeled “groceries” and if you spend $200 on bills- you would allocate that into the envelope “bills”. Once you fill the envelopes you cannot spend more than what is allocated. This is a great way to stay mindful of your spending and make sure that your money is going towards necessary expenses.

The envelope technique is a great way to stay mindful of your spending and it can help you reach your savings goal faster.

There are many ways to save money and reach your goal of $5000 in three months. It will take some effort and dedication, but it is definitely achievable! Just remember to create a budget, cut back on unnecessary expenses, cook at home, make extra money, and use the envelope technique!

How can I save $5000 in 3 months Chart:

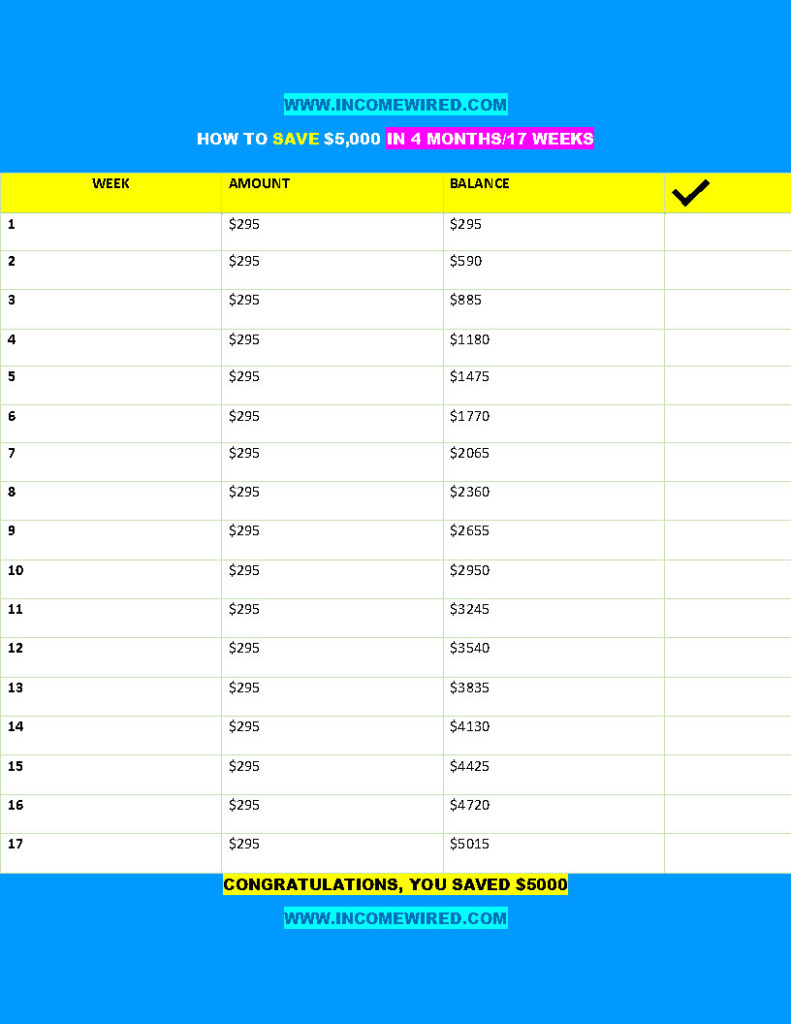

How to save $5000 in 4 months

Saving $5000 in 4 months is doable but will require you to think about needs vs. wants, make some lifestyle changes and be diligent about saving. Create a budget and stick to it: This is probably the most important tip when it comes to saving money. You need to be aware of your spending patterns in order to make changes. Track all of your expenses for one month so that you can get an idea of where your money goes each month. Once you have a good understanding of your spending patterns, you can start making adjustments. To save $5000 in 4 months we will do the following:

$5000 divided into approximately 17 weeks: $295 dollars per week will need to be saved.

How to save $5000 in 4 months Chart

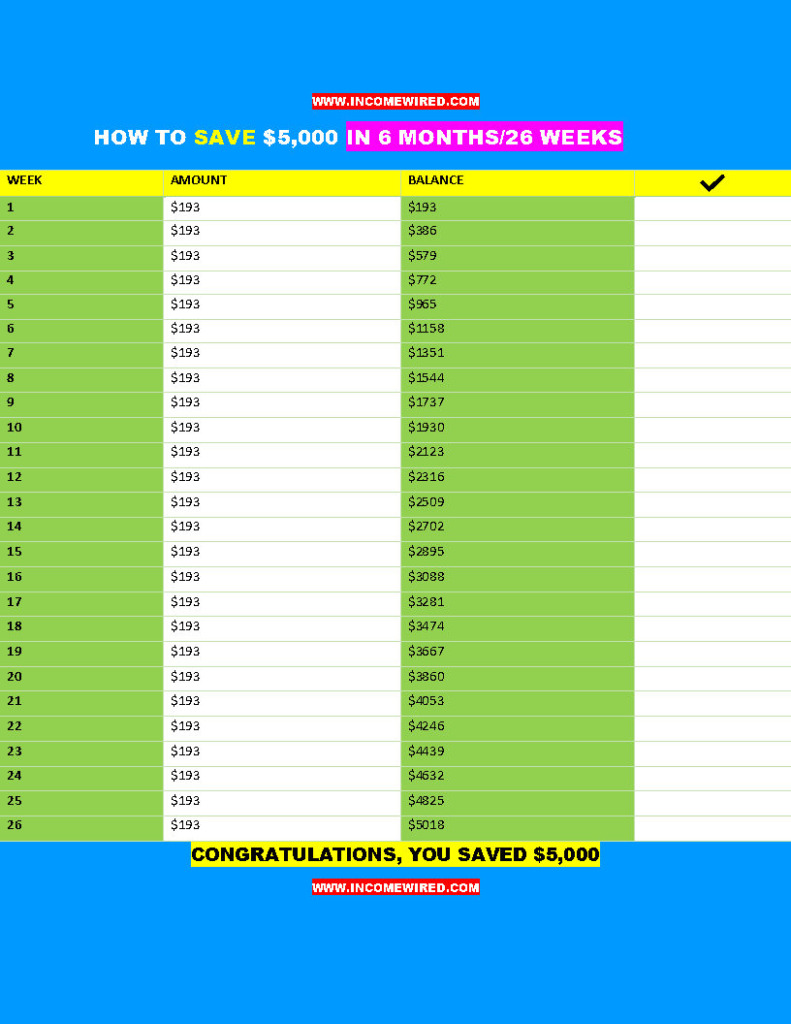

How to Save $5000 in six months

If you have a bit more time to reach your savings goals, you may want to consider saving $5000 in six months. This may seem like a lot of money, but it is definitely achievable with some lifestyle changes and commitment. Here are some tips on how to save $5000 in six months:

-Create a budget and stick to it, although this seems to get repeated a lot, having financial discipline is very important

-If you have a job, you can select to place some of your earnings into a special savings account each month so that you are not tempted to spend it

-Make a list of all of your debts and start chipping away at them. The more debt you can pay off, the more money you will have available to save each month

-Start cooking at home, meal prepping, or packing your lunch instead of buying it. This can save you a lot of money over time

-Find ways to make extra money. You could start freelancing, take on a part-time job, or even start a side hustle. Any extra income can help speed up the process of reaching your savings goal

How to Save $5000 in six months Chart

What is the quickest way to save $5000?

The quickest way to save $5000 is to make, generally speaking, make more money. Making more money will require you to look for opportunities to make extra money. You could start freelancing, take on a part-time job, or even start a side hustle. Any extra income can help speed up the process of reaching your savings goal. Another way to save $5000 quickly is to make changes to your spending habits. This means creating a budget and sticking to it, as well as cutting back on unnecessary expenses. Finally, another way to save $5000 quickly is by paying off any debts that you may have. The less debt you have, the more money you will have available to save each month.

Is it possible to save $5000 in a year/52 weeks?

Saving $5000 in a year is doable if you save an average of $96 per week. This may seem like a lot of money, but it is definitely achievable with some lifestyle changes and commitment. When you are getting ready to buy the next trending tech, consider that you have a goal you must achieve, and with some discipline, you can make it happen.

How much should I save each month to reach my goal?

If you want to save $5000 in a year, you need to make sure that you are saving at least $417 each month. This may seem like a lot, but it is definitely achievable with some lifestyle changes and commitment. Try to make extra money whenever possible and cut back on unnecessary expenses in order to reach your goal.

It can be difficult to save money, especially when there are so many tempting things to spend it on. However, saving money is important if you want to reach financial security.

How to save $5000 in a year/52 weeks chart

How long does it take to save up $5000

The answer to this question depends on a few factors, such as your income, your spending habits, and your savings goals. If you are able to make extra money and cut back on unnecessary expenses, you could save $5000 in as little as six months. However, if you want to be more conservative with your savings plan, you may want to consider saving $5000 in a year. Regardless of how long it takes you to reach your goal, the important thing is that you remain committed and don’t lose focus on your goal.

Overall saving $5000 for any set amount of time is a difficult task, but not impossible. Focus on your goal and write you expenses you have per month with what your income is, setting a realistic goal for yourself. After some time you will see your numbers going up and feel better about your financial situation.