we help service-based business owners, freelancers, and aspiring businesses with our content & services & When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Find out more about Income Wired

Let’s face it, most people are not comfortable or familiar with how to write a check for cash withdrawal. That is perfectly understandable because, in this day and age, we are so used to using debit and credit cards for almost everything, but at times we need to pay for something or some service in cold hard cash. Not everyone can carry thousands of dollars of cash around with them, so for larger withdrawals, a check is the best way to ensure you get your money. In order to do so, we have two options: we can either write a check or get a money order. If you have never written a check before, then this task may seem daunting, but it is actually quite simple once you know how.

If you are a person or business writing a check for someone to cash it, it’s important to make sure the check is properly filled out to avoid any potential issues. In addition, make sure you have the correct amount of cash on hand to cover the check.

What is a check?

A check is a document that orders a bank to pay a specific amount of money from your account to the person or company named on the check. When you write a check, you need to sign it and date it. The recipient can then take the check to their bank and cash it or deposit it into their own account.

Why are checks useful?

Checks are useful because they provide a written record of the transaction. This can be important if there is ever a dispute about whether or not the recipient received the money. Checks are also a relatively secure way to pay someone, as they cannot be cashed without your signature.

Is paying someone in cash the same as writing a check?

No. When you pay someone in cash, there is no written record of the transaction. This can be problematic if there is ever a dispute about whether or not the recipient received the money.

Writing a check for cash withdrawal benefits

- Offers a written record of the transaction

- Check is a relatively secure way to pay someone

- The check cannot be cashed without your signature

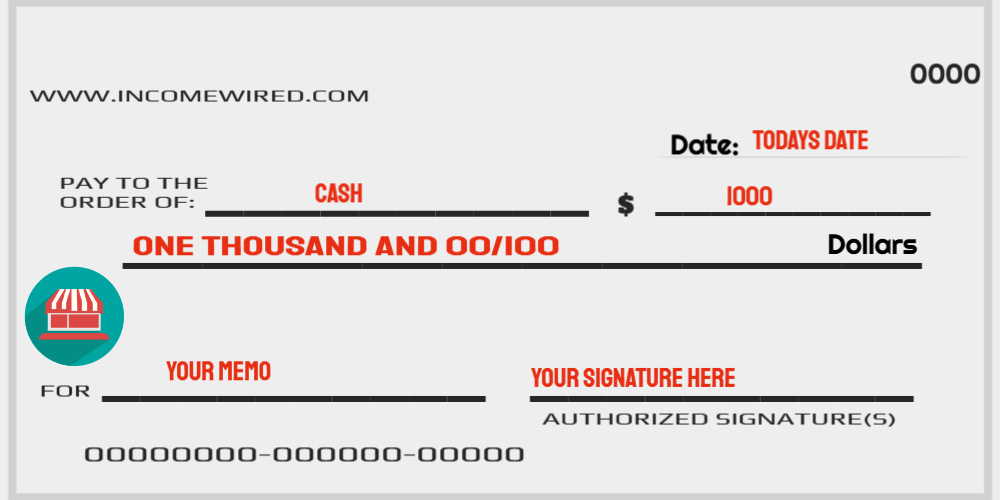

How to write a check for cash withdrawal :

First, you will need to find a blank check in your checkbook. Next, you will need to fill out the dateline on the top right

Let’s look at this scenario: You need to pay your rent, but you do not have enough cash on hand and your landlord does not accept debit or credit cards. So, you will have to write a check.

This is completely ok and understandable. Let’s take a look at how to write a check for cash withdrawal step by step so that you can do it with confidence the next time you need to.

The first thing you will need is a pen. It is very important that you use a pen and not a pencil because if the check gets wet, the ink will run and the check will be unreadable. Second, you will need a check from your personal checking account. If you do not have any checks, then you can order them from your bank or credit union.

Once you have these two items, you are ready to start writing the check. The first thing you will do is fill in the date on the top right-hand side of the check. This is the date on which you will be writing the check.

The next thing you will do is fill in the name of the recipient in the “Pay to the Order Of” line. This is usually the name of the person or company you are paying, but it could also be cash if you are withdrawing money from your account.

After that, you will need to fill in the amount of money you are writing the check for in two different places. The first place is on the line that says “Dollars.” Here, you will write out the full amount of money you are paying, using words and not numbers. For example, if you are paying $1000, you would write out “One thousand dollars and 00/100” The second place you will need to fill in the amount is on the line below that says “Amount.” On this line, you will write out the amount of money you are paying using numbers only. So, for our example of $1000, you would write “1000.00.”

The next thing you will do is sign the check on the bottom right-hand side. This is very important because it is what makes the check legal and binding. Once you have signed the check, you are done! All you need to do now is hand it over to the recipient and they can cash it or deposit it into their account.

When you give them the check for cash withdrawal, it is a good idea to make sure the funds are available in your account first. This can be done by checking your online banking account or by calling your bank or credit union.

Writing a check may seem like a complicated process, but it is actually quite simple once you know how. The next time you need to pay someone in cash, just follow these easy steps and you will have it done in no time!

Voiding the Check

What happens if for some reason you need to void the check after you have written it? This can happen if you make a mistake when writing it out or if the recipient decides not to accept it. To void a check, all you need to do is write the word “Void” across the front of it in big, bold letters. Once you have done that, the check is no longer valid and can’t be used. So, if you need to cancel a check for any reason, make sure you write “Void” on it first!

People Also Ask:

How soon can a recipient cash a check?

There is no precise answer to this question as it can vary depending on the bank or credit union. However, it is generally recommended that you wait at least 24 hours after writing the check before cashing it yourself. This will give the check time to clear and ensure that there are no issues with it.

Can I write a check to myself for cash?

Yes, you can write a check to yourself for cash. However, you will need to sign the check first and then take it to your bank or credit union to cash it. You may also be charged a fee for cashing the check.

What happens if I accidentally write a check for too much money?

If you accidentally write a check for too much money, you will need to contact the recipient and ask them to return the excess funds to you. You may also be charged a fee by your bank or credit union for writing a check for more money than you have in your account.

What should I do if I lose my checkbook?

If you lose your checkbook, you will need to contact your bank or credit union as soon as possible. They will be able to cancel your old checks and issue you new ones. In the meantime, you can use another form of payment such as cash or a debit card.

What happens if I write a check and it bounces?

If a check bounces, it means that there was not enough money in the account to cover the amount of the check. The recipient will not be able to cash the check and you will be charged a fee by your bank or credit union. You will also need to repay the amount of the check to the recipient.